With its unparalleled privacy features, low maintenance costs and ease of establishment the Seychelles IBC has risen to become the preferred International Business Company for discerning investors and entrepreneurs the world over.

Advantages of the Seychelles IBC include:

- Exemption from all Seychelles taxes, including income/business tax, stamp duty and capital gains tax

- Owners and Directors details are not publicly available

- No need to hold annual general meetings

- No need to have accounts audited or to file annual returns

- Low set up and admin costs

- Can carry out a wide variety of activities as of right

Practical Uses for Seychelles IBCs:

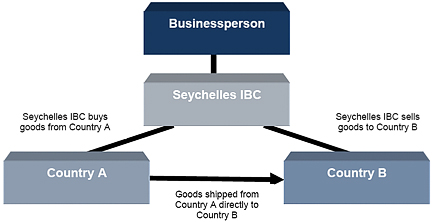

Case Study 1: International (i.e. cross-border) trading

Seychelles IBCs are commonly used by Exporters and Importers alike.

Trading profits resulting from the sale of goods in such situations are not taxed in Seychelles.

Generally speaking, pursuant to the principles of International Tax law:

- The purchase of the goods in the above example should not give rise to taxation in Country 1; and

- Provided that the Seychelles IBC does not have a “permanent establishment” nor a

fixed business address/office in country B, then no tax assessment should be levied

against the IBC in country B

For more information on this topic (or if you would like to know more about How We Can Help You) please Contact Us

This is a generic example of how an offshore corporate entity can or might be used. Local laws may impact on your situation. Hence we would recommend that you seek local legal and/or tax advice before establishing such an entity